Big Lots Stock Buyback

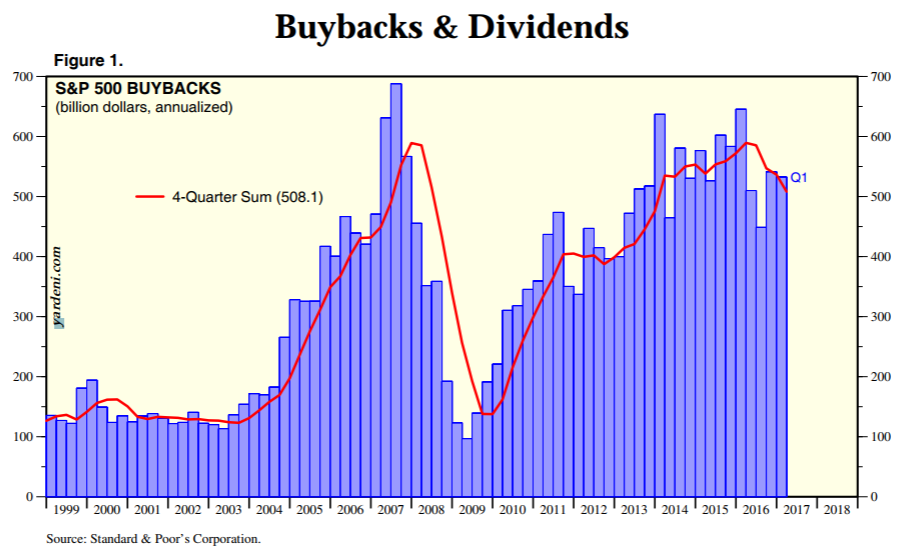

Instead, the dominant company response to the TCJA was stock buybacks. For the first three quarters of 2018, buybacks were $583.4 billion (up up 52.6% from 2017). Off-price retailer Big Lots (NYSE:BIG) announced it has completed the $725 million sale-leaseback transaction for four of its distribution centers and is ready to use a portion of the proceeds from.

© Provided by The Motley Fool Why Big Lots Stock Was Down Big on FridayWhat happened

Shares of Big Lots(NYSE: BIG) fell on Friday, after the company reported results for the second quarter of 2020. The quarterly results were actually among the best in company history. But with the stock already trading at its highest price in the past two years, it seems investors are content to take some profits off the table.

Besides trading at two-year highs, Big Lots stock was up almost five times from lows earlier in 2020, making it all the more tempting to cash out. As of 2:15 p.m. EDT, the stock was down 11% for the session.

© YCharts BIGSo what

In Q2, Big Lots' net sales grew 31% year over year to $1.25 billion. By generally accepted accounting principles (GAAP), it earned $11.29 per share -- which looks eye-poppingly impressive next to the mere $0.16 it earned last year. The GAAP earnings include $8.75 per share of a one-time benefit from a sale-leaseback transaction. But even after adjusting for this, $2.75 earnings per share is nothing to sneeze at.

Over the past year, Big Lots has made a lot of progress on its balance sheet. Last year, it had $468 million in long-term debt and $54 million in cash and equivalents. Now, it has $899 million in cash and equivalents and just $43 million in long-term debt. Granted, its cash balance is set to come down. In Q2, its inventory decreased 18%, so the company needs to spend to replenish inventory. And it owes taxes on its sale-leaseback gains. But it's a solid balance sheet nonetheless.

Now what

From a retail business perspective, it's fair to question how Big Lots will perform in coming quarters. In Q2, furniture sales contributed the biggest dollar amount to its revenue growth. Logically, a furniture-sales increase is only temporary, and will mitigate in coming quarters. In other words, investors shouldn't expect this level of growth going forward.

Popular Searches

Investors can expect Big Lots to return capital to shareholders. It's paying a regular quarterly dividend of $0.30 per share on Sept. 25, and it just announced it's authorized to repurchase $500 million in shares. For perspective, the value of all its shares (a metric called market capitalization) is less than $2 billion. Therefore, this is a massive buyback plan that can boost per-share profit in the future even if growth slows.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Big Lots Stock Buyback For Cash

SPONSORED:

SPONSORED: 10 stocks we like better than Big Lots

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

Starbucks Stock Buyback

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Big Lots wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Companies With Stock Buyback Programs

*Stock Advisor returns as of August 1, 2020